Innovation and invention are central to Amazon India's business. Amazon India continues to grow its digital footprint in India and has been actively catalyzing the digital India movement by making digital transactions easy, convenient, and rewarding. Through its digital payments infrastructure, Amazon India empowers over 85 lakh small businesses and entrepreneurs by facilitating the acceptance of payments from customers via Amazon Pay.

Service becomes faster and we face fewer problems when Amazon Pay is used.

From local kirana stores to stores selling electronic goods or fashion and beauty products, Amazon Pay and its innovative payment offerings simplify merchant lives every day. Sharing some of the benefits of using Amazon Pay, Sai, owner of Sai Apollo Medical Store in Andhra Pradesh, says, “Service becomes faster and we face fewer problems when Amazon Pay is used. The platform makes it easier to handle transactions. Since my competitors do not offer the option of digital payments, customers prefer to buy from me. This has greatly benefited my business.”

Digitally-enabled everyday transactions

Previously, these merchants operated largely through cash transactions. Now, they accept payments from their customers using Amazon Pay's QR code, which can be used by any UPI app. The Amazon Pay for Business app, voice notifications, and easy access to working capital loans have also contributed greatly to the convenience of such micro-businesses and merchants.

Now, we conduct over 25-30 transactions per day with the help of Amazon Pay.

“With digital transaction services like Amazon Pay, the average retail store owner like me is finding it easy to keep customer accounts in check. Earlier, when cash was more prevalent, we often found it challenging to make the day’s finances reflect in our bank accounts, as a number of micro-transactions with loose change would muddle the amount at hand,” said Pawan, who runs a food joint in Barasat, West Bengal.

“Now, we conduct over 25-30 transactions per day with the help of Amazon Pay. Every store owner in the vicinity is transitioning to digital payments. Easy access to UPI-based transactions has solved the problem we used to face earlier,” he added.

Hassle-free business

Amazon Pay, aims to empower merchants by connecting them to the internet and providing opportunities to expand their businesses. Enhancing the payment experience is simply one of the multiple contact points used by Amazon Pay to deliver a quick, hassle-free digital journey for SMBs.

“Amazon Pay is convenient because the money goes from the customer’s bank account to our (the retailer’s) bank account. We don’t have to keep extensive account books, or travel to banks to deposit our money,” said the owner of a salon in Telenipara, West Bengal.

Unique features

Amazon’s goal of providing sellers with a world-class e-commerce platform is being realized through the introduction of features such as the Amazon Pay for Business app. This app allows business owners to track and understand business health, accept payments from various UPI apps, get instant answers to queries, and stay up to date on Amazon offers and discounts.

Building Aatmanirbhar Bharat

In its journey to bridge the digital divide between India and Bharat, Amazon Pay has enabled a diverse ensemble of small merchants and entrepreneurs.

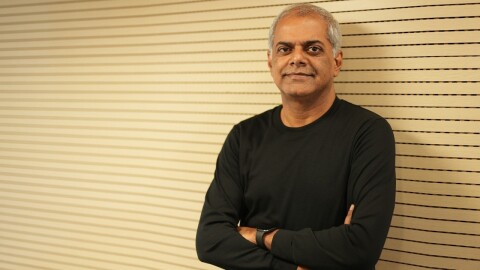

This milestone is a testimony of the trust that India’s 85 lakh+ SMBs have on us and we are truly humbled.

Elaborating on Amazon India’s vision for the digital payment system, Mahendra Nerurkar, CEO & VP, Amazon Pay India said, “SMBs form the backbone of India’s economic growth. Our aim is to empower offline merchants, provide them with opportunities to expand their businesses, and enhance their payment experience among multiple other touch-points that expedites their digital journey. This milestone is a testimony of the trust that India’s 85 lakh+ SMBs have on us and we are truly humbled. We will continue to remain focused in our efforts to bring forth holistic initiatives, transform the way India pays and further catalyze the payment acceptance ecosystem for SMBs,” he added.